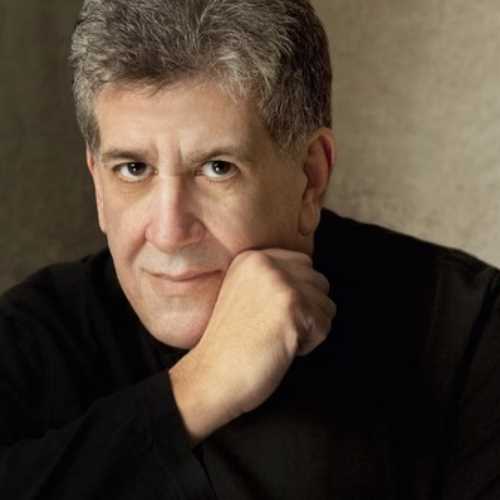

Andrew Friedman

- Principal and Founder, The Washington Update

- Political Affairs Expert and Financial Analyst

- According to CNBC, Andy Friedman is "one of the nation's most sought-after speakers on all things political."

Travels From

District of Columbia

Andy Friedman discusses the fiscal deadlines facing Congress in 2013

Andy Friedman Discusses President's Ability to Enact his Policies

Andrew Friedman Speaker Biography

Andy Friedman is one of the nation's most sought-after speakers on political and legislative developments and their effect on the government's tax, fiscal, and retirement policies.

According to CNBC, Andy Friedman is “one of the nation’s most sought-after speakers on all things political.” An expert on political affairs, he is known for predicting the outcomes of Washington tax and fiscal deliberations and providing financial advisors and investors with strategies to consider in light of the changing political landscape.

Friedman was a senior partner with the law firm of Covington & Burling in Washington, D.C., where he practiced for almost thirty years, serving as head of the tax and corporate groups. He received his bachelor degree as valedictorian from Trinity College in Hartford, Connecticut, and his law degree from the Harvard Law School.

Friedman also served as tax counsel to Major League Baseball, the National Football League, the National Basketball Association, and the National Hockey League.

Friedman appears on CNBC, which refers to him as “Wall Street’s Tax Expert” and calls him “one of Washington’s savviest political observers.” He also has appeared on The Larry Kudlow Show, Fox Business Channel, and POTUS radio, has been profiled in The Washington Post and Research magazine, and is quoted extensively in publications ranging from The Wall Street Journal to USA Today.

Friedman is included in Best Lawyers in America and Chambers’ America’s Leading Lawyers for Business, which notes that “Andy’s ability to combine vast knowledge and a practical mindset permits him to convey the most complex of tax concepts in layman’s terms. He is the expert’s expert. If every lawyer were like him, the world would be a much better place.”

To book Any Friedman call Executive Speakers Bureau at 901-754-9404.

Health Care Reform Takes Effect: What Choices Do Businesses and Individuals Have?

The deadline for sign-ups under the Affordable Care Act has now passed, but the effects of the law -- including on the midterm elections -- remain to be seen. Will participants be surprised by high deductibles, premium increases, and a narrow range of service providers? Will the IRS be able to enforce penalties on non-participants? This presentation explains -- in simple, non-partisan, easy to understand language -- the parts of the health care reform law that affect businesses and individuals, and the considerations going into the decisions they must make.

The Washington Update: Effects on Small Business Owners

Much of what happens in Washington affects small businesses. On one hand, Washington recognizes that small businesses provide an outsized source of potential employment. On the other hand, the need for additional tax revenue to fund government initiatives jeapordizes the continuation of many current small business initiatives. The presentation will address political topics of interest for small business owners, including tax reform, the Affordable Care Act (Obamacare), under which many smaller businesses will be required to offer insurance to employees beginning in 2016, entitlement (Social Security and Medicare) reform, foreign trade accommodations that could adversely affect domestic businesses and, of course, the upcoming election, where candidates have differing ideas on how to treat small businesses.

The Washington Update: An Overview of the Political Environment, Prospective Legislation and Strategies for Investment and Retirement Planning

In early 2011, Andy Friedman, an expert on Washington political affairs, predicted a stalemate on meaningful deficit reduction efforts, the risk of a downgrade in the credit rating of U.S. debt, severe negative reaction from China, and a market swoon beginning in May (when federal stimulus ran out and spending cutbacks began). This year Andy will review the Presidential and Congressional political campaigns and the initiatives likely to emerge from the election results, including efforts to reduce the federal budget deficit, create jobs, and extend the “Bush tax cuts” slated to expire at year end. Andy also will discuss the future of health care reform, likely business tax changes, the estate tax, entitlement reform, and retirement planning.

Andy will provide strategies that investors and financial advisors might consider to take advantage of (or protect against) the current fiscal and tax environment, including specific strategies for investment, wealth transfer, and retirement planning.