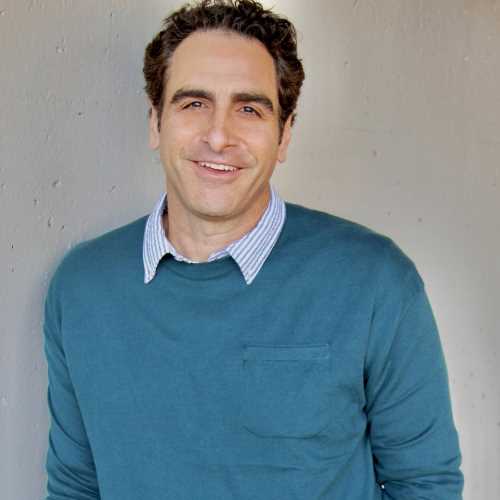

Richard Bowen Speaker Biography

According to the Wall Street Journal, CBS Evening News, and 60 Minutes, Richard Bowen is the Citigroup whistleblower who repeatedly warned Citi executive management about risky business practices and potential losses related to mortgage lending. As a Business Chief Underwriter for Citigroup during the housing bubble financial crisis meltdown, he saw fraud firsthand inside the organization. He watched with disbelief at the way the company certified poor mortgages as quality mortgages and sold them to Fannie Mae, Freddie Mac and other investors.

For two years he repeatedly warned executive management and the board of directors. His warnings were ignored, despite the fact that withholding such information from shareholders and investors violated the Sarbanes-Oxley act. Citigroup eventually stripped him of all responsibilities, placed him on administrative leave and told him his presence was no longer required at the bank. Richard subsequently testified before the Securities and Exchange Commission and gave them 1,000 pages of evidence of fraudulent activities, with the bank bailouts occurring three months later. In 2010, Richard was a key witness in the mortgage mishaps as he gave nationally televised testimony before the Financial Crisis Inquiry Commission. He was shocked to see the orchestrated efforts to hide key parts of his testimony from the American public.

Richard’s testimony has been widely quoted in numerous articles and pieces of litigation related to the meltdown. Despite years of extensive coverage and numerous subpoenas with additional testimony, he is dismayed that no one has been held accountable for what happened at Citigroup or other financial institutions, and no one has been prosecuted for the massive fraud that contributed to the financial crisis.

Richard has taken the lessons learned from his 35 years of business experience and is now working with organizations that want to do things the right way. He speaks and consults with executives who want to build organizations with accountable and ethical corporate cultures. As a highly sought-after speaker on ethical leadership, he shares his firsthand knowledge of how a company can get into ethical problems. More importantly, he explains in clear terms what an organization must do to instil effective guiding principles throughout the organization to prevent ethical misconduct and leadership missteps.

Richard also reaches out to the up and coming business leaders as a professor of accounting at the University of Texas at Dallas.

Penn Mutual Chairman, CEO, and President Eileen McDowell had this to say about Richard Bowen’s presentation to her organization: “Richard Bowen reinforced my motto that “there is no right way to do a wrong thing.” Long after his presentation, the conversation has continued about personal responsibility and the courage to challenge things that appear to be wrong. We encourage this dialogue and rely on it to help make our business stronger.”

His engaging stories keep audiences on the edge of their seats. His extensive research into corporate malfeasance and his personal experience of trying to prevent his own employer from going down a dangerous path, leave audiences inspired and enthused. He shares practical guiding principles to prevent potential mishaps that can be incorporated into their own organizations. The end result is more engaged employees, more responsible management and a recognition that a discipline of trust and transparency throughout an organization leads to a more profitable, productive company.

Mr. Bowen has a B.S. in Mechanical Engineering from Texas Tech University and a Masters of Business Administration from the University of Texas at Austin. He is a Certified Public Accountant and was named CPA of The Year (2012) by the Dallas Society of CPA’s and Dallas’ D CEO Magazine recognized him as the 2012 recipient of its annual Financial Executives Award for Excellence in Corporate Governance.

Playing for High Stakes: The Principles and Practice of Ethical Leadership

The financial debacle of 2008 and the fallout it caused to our economic infrastructure has prompted increased concern of corporate moral and social responsibility and increased scrutiny of organizational behavior and the lack of ethical leadership exhibited by companies we previously held in high esteem.

There is a zero tolerance and societal concern towards unethical behavior. Unethical behavior has a high cost: lack of trust on the part of customers, the public as well as employees. Diminishing loyalties mean fewer profits and less engaged employees.

Based on Richard’s true life experience and client case studies, this no holds barred presentation focuses on the costs of unethical leadership and the steps an organization needs to take to instil guiding principles that become part of the corporate culture. It points out the slippery slope that leads to a lack of ethical culture and how to prevent this from happening within your own organization.

Dark Citi: The Story of a Whistleblower

As a Business Chief Underwriter for Citigroup during the housing bubble financial crisis meltdown, Richard saw fraud firsthand inside the organization. He saw the company certify poor mortgages as quality mortgages and sell them to Fannie Mae, Freddie Mac and other investors.

For two years, Richard repeatedly warned executive management and the board of directors and was ignored. Eventually, he was stripped of all responsibilities, placed on administrative leave and told his presence was no longer required.

Richard has testified before the Securities and Exchange Commission and the nationally televised Financial Crisis Inquiry Commission. He has been interviewed by major venues from 60 Minutes to the New York Times and widely quoted in numerous articles and pieces of legislation related to the mortgage meltdown.

He is concerned that we have not learned from the 2008 financial meltdown and are again headed in the same direction, with Citi writing directives that Congress is accepting that will loosen credit standards once again.

He incorporates the harrowing story behind Citi and what led to his whistleblowing with lessons taken from his 35 years of businesses experience to give insights into how to prevent fraud and another financial crisis of even bigger dimensions.