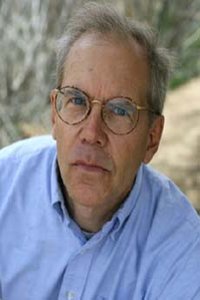

Peter Zeihan

- Worked for the U.S. State Department and a premier private intelligence company

- Launched his own firm, representing clients in various sectors including energy, finance, and defense

- Discusses America’s economic outlook and the future of industries such as manufacturing and agriculture

In Person-Fee 🛈

$50,000 - $100,000

Virtual Fee:

$30,000 - $50,000

Travels From

Texas

Geopolitical Strategist Peter Zeihan speaks in Shreveport, LA at BRF Annual Event

Peter Zeihan Speaker Biography

Peter Zeihan is a geopolitical strategist, which is a fancy way of saying he helps people understand how the world works. Peter combines an expert understanding of demography, economics, energy, politics, technology, and security to help clients best prepare for an uncertain future.

Over the course of his career, Peter has worked for the US State Department in Australia, the DC think tank community, and helped develop the analytical models for Stratfor, one of the world’s premier private intelligence companies. Peter founded his own firm — Zeihan on Geopolitics — in 2012 in order to provide a select group of clients with direct, custom analytical products. Today those clients represent a vast array of sectors including energy majors, financial institutions, business associations, agricultural interests, universities and the U.S. military.

With a keen eye toward what will drive tomorrow’s headlines, his irreverent approach transforms topics that are normally dense and heavy into accessible, relevant takeaways for audiences of all types.

Peter is a critically-acclaimed author whose first two books — The Accidental Superpower and The Absent Superpower — have been recommended by Mitt Romney, Fareed Zakaria and Ian Bremmer. His forthcoming third title, Disunited Nations: The Scramble for Power in an Ungoverned World will be available late-2019.

To book Peter Zeihan call Executive Speaker Bureau at 901-754-9404.

Getting Through the End of the World

For the past decade, Peter has been discussing the nature, strength and weaknesses of the international system. How post-World War II institutions, geography and demographics have made our world our world…and how it was never going to last. Well, we are now at that world’s end. Any number of factors – the Ukraine War, the fall of China and Germany, energy breakdowns, supply chain collapses, workforce shrivelings, financial contractions, and so on – would independently be sufficient to break the international economy. And they are all happening at once. We were always going to get here, and here we are. So let’s discuss what happens next.

Manufacturing (in) a New World

Manufacturing is an endlessly specialized and complicated venture, with most manufacturers directly or indirectly sourcing components from around the country and the world. But what if the ability to sail components from site to site becomes compromised? What if capital availability proves insufficient to update industrial bases as technology evolves? The successful manufacturers of the future will be those who can command access to raw materials, capital, labor, and markets – within defined areas of proximity. Such days are nearly upon us. Differences in COVID recovery and demographic structures are intermingling with failing Chinese relationships to push manufacturing in an entirely new direction.

After the Peak: Finance in an Age of Loss

For the past three decades our world has known ever-rising volumes of money. Whether from Wall Street, the Federal Reserve, Europe or East Asia, this rising tide of capital at ever-cheaper rates has defined the post-Cold War era. It’s ending. Now. For reasons geopolitical and demographic, the globalization of finance is in its final months just as the overall inflows are dissolving for reasons demographic. This isn’t momentary. We will not return the capital structure of the 2000s and 2010s within our lifetimes. The questions now become how deep the crash will be, which sectors will suffer the most, and what islands will be able to weather the coming financial storm?

At the Edge of Disorder

The concept of countries being able to buy and sell their wares openly on the international marketplace is inviolable. The freedom to sail one’s products around the world is a given. Everything from the transfer of money to the accessibility of energy is sacrosanct. Yet all this and more is artificial: an unintended — if happy — side effect of the American-led global Order. With that Order in its final days, all countries and all industries must learn to operate in a world as unstructured as it is dangerous. Join us as Peter Zeihan lays out how we got to where we are, and what the future holds for sectors as diverse as energy, agriculture, finance, manufacturing and transport.